NO NEED TO STRETCH YOUR FINANCES TO THE LIMIT OR GAMBLE WITH YOUR FUTURE:

Australia’s Ultra-Rich Aren’t Hoping & Praying For Hotspot Suburbs To Boom… Here’s What They’re Doing Instead

Discover The New “Micro Warehouses” Building Passive Retirement Portfolios Fast!

Property “experts” and “gurus” left in shock - discover the most lucrative investment opportunity in the 2025/26 property market for building a $168k+ P/Y retirement portfolio 10 years earlier.

as seen in

The Retirement Accelerating Strategy Could Add $30,000- $70,000 In Equity To Your Nest Egg This Year…

It’s getting harder to get ahead in Australia. Groceries are up. Fuel is up. Childcare, insurance, rent… almost everything costs more. And the property market? The average house in most capitals now tops $1 million, pricing many families out of home ownership, let alone investing.

Getting ahead and building long-term financial security requires more than just saving hard or piling into a negatively geared property. It requires cash flow. Leverage. And a strategy that actually works in today’s economy. With up to 3.1 times the yield of residential property, equity growth, and prospects for substantial annual passive income, our ‘Micro Warehouse’ strategy ticks all the boxes..

The Retirement Accelerating Strategy Could Add $30,000- $70,000 In Equity To Your Nest Egg This Year…

$1B Engineering Track Record

6% Yield Guarantee

$30k–$70k Equity Uplift

Precinct Tagging for Capital Growth

$168k+ Passive Income Pathway

Fully Managed, Pre-Leased Assets

Low Yields, High Costs, And Dead Money: Residential Real Estate Investing Is Sabotaging Millions Of Aussies' Retirement Plans…

Low Yields, High Costs, And Dead Money: Residential Real Estate Investing Is Sabotaging Millions Of Aussies' Retirement Plans…

Despite what you might have heard in the press, not every 27-year-old is buying seven investment properties and retiring on a six-figure income. The reality is far more stark, and in many cases, the numbers just don’t stack up. CoreLogic puts average gross yields on residential real estate at just 3.7%. In Sydney, it’s often closer to 3%.

After accounting for insurance, management fees, and maintenance, most investors are left with less than 2% in net income. Hardly a fast-track to wealth… that’s why we focus on an entirely different way of investing. One that takes advantage of a multi-billion-dollar “guaranteed first year rental income” trend.

But With 3.1X Higher Yields And Up To $25 Billion Inflowing, Industrial Storage Is Booming…

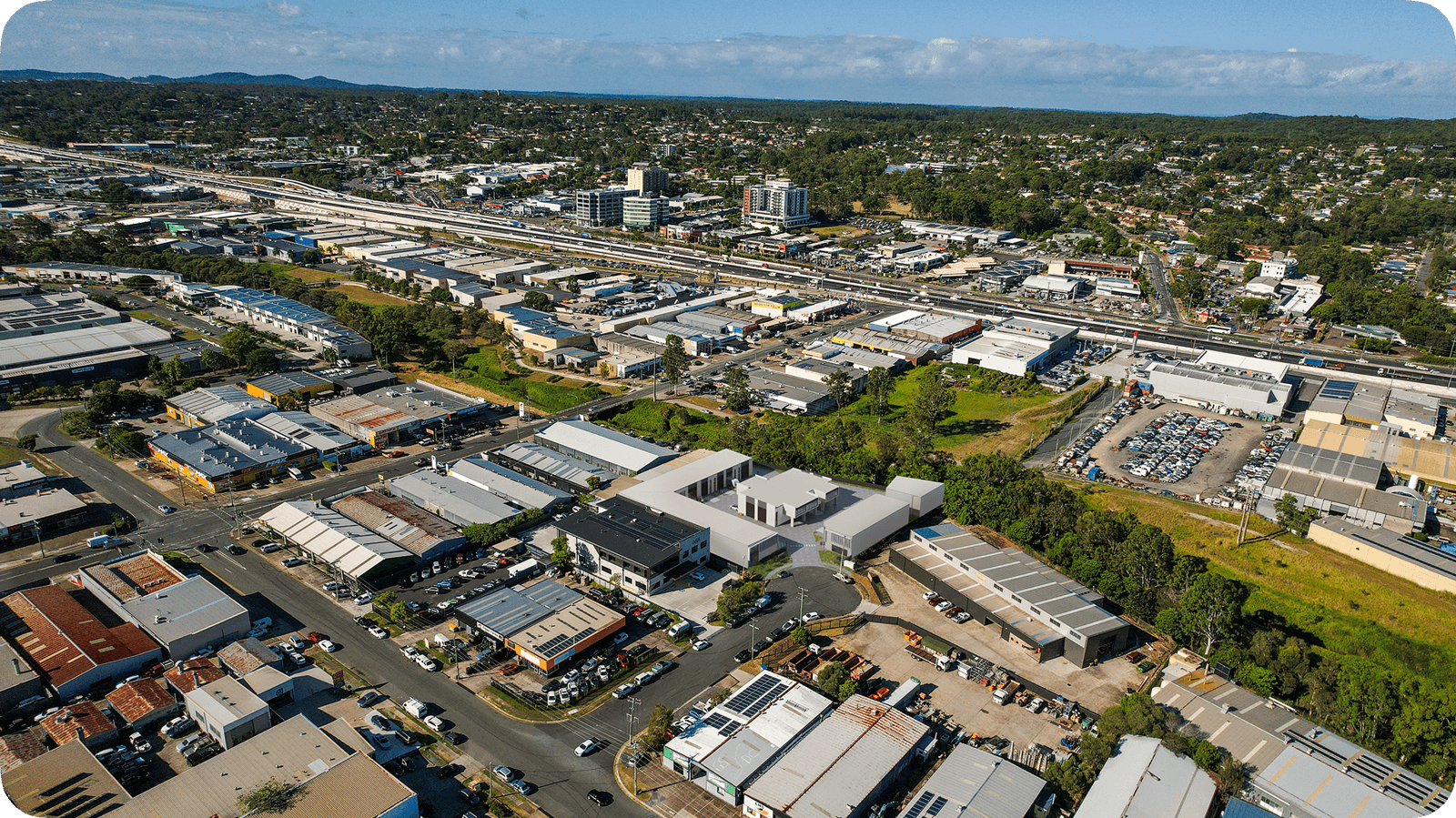

Right now, Australia is facing a surge in demand for industrial property. National vacancy rates have fallen to an extraordinary 2.8 percent. E-commerce, last-mile delivery, AI data centres, and a wave of small to mid-sized businesses are all competing for the same limited warehouse, storage space, and underlying land. In key hubs like Brisbane, industrial land is so scarce that experts forecast it could run out entirely within five years, adding even more pressure to an already booming asset class.

According to recent forecasts, the warehousing and storage market in Australia is projected to double from approximately $27.5 billion in 2024 to over $59.3 billion by 2034. This isn't a short-term spike. It's an enduring, multi-billion-dollar shift. And the investors who position themselves now stand to benefit most.

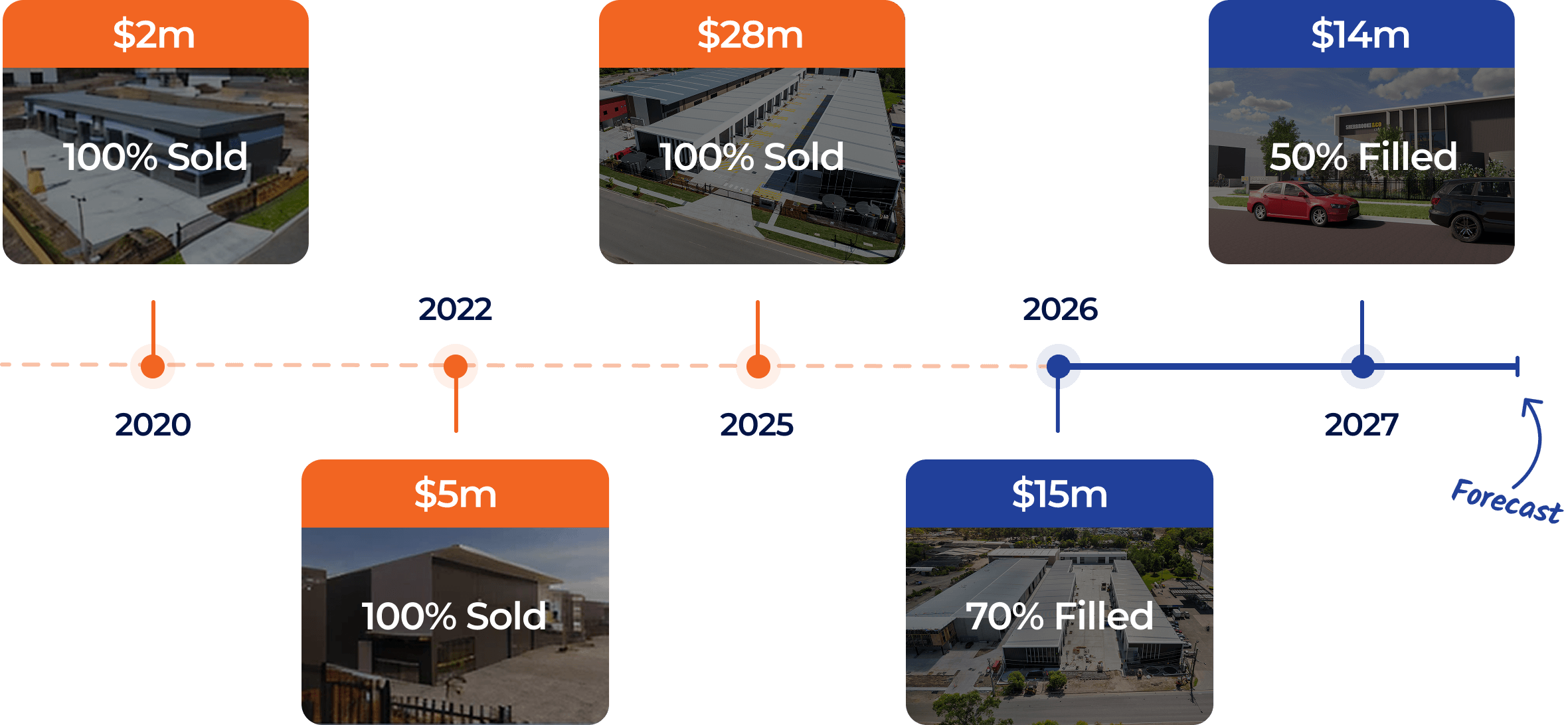

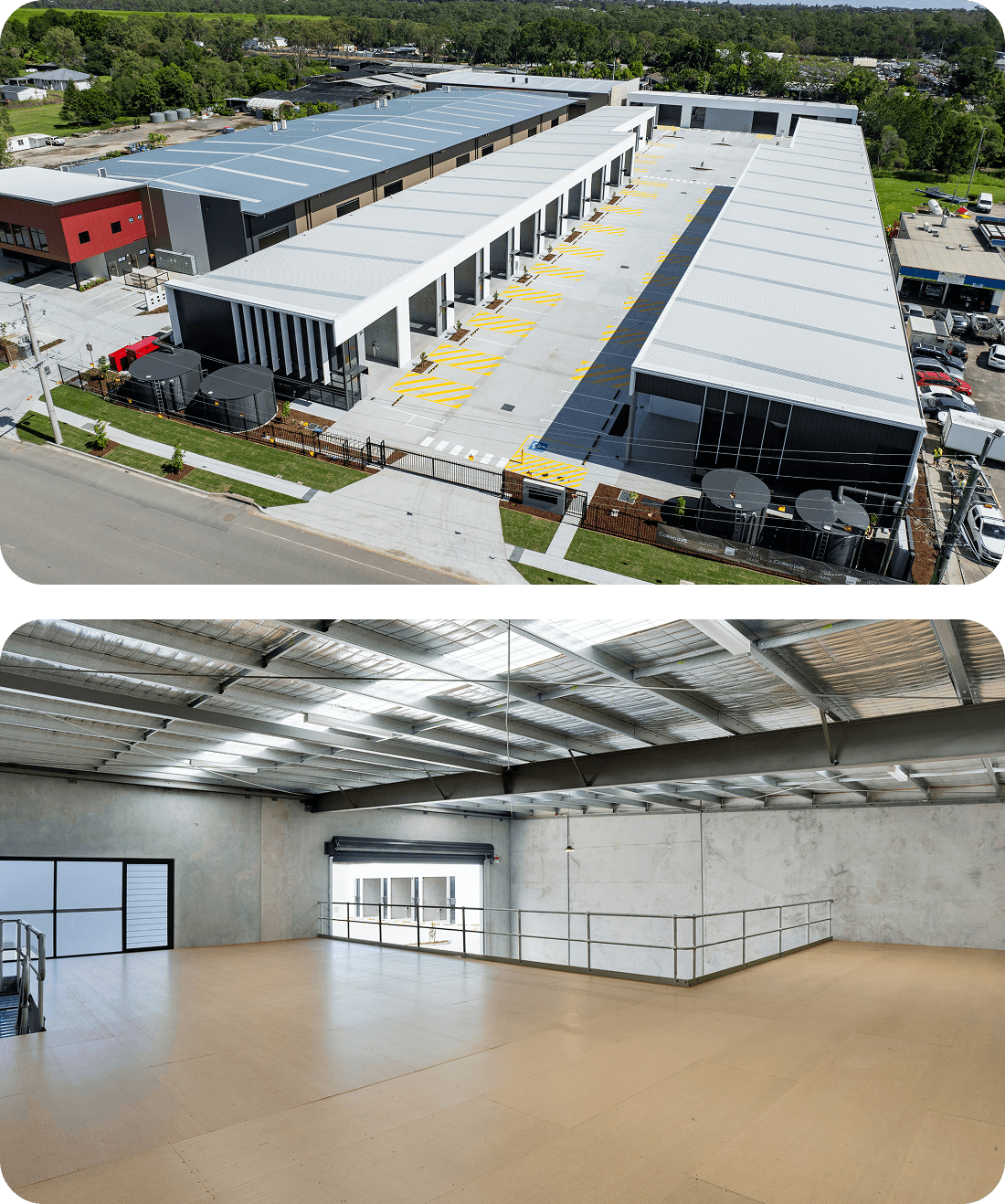

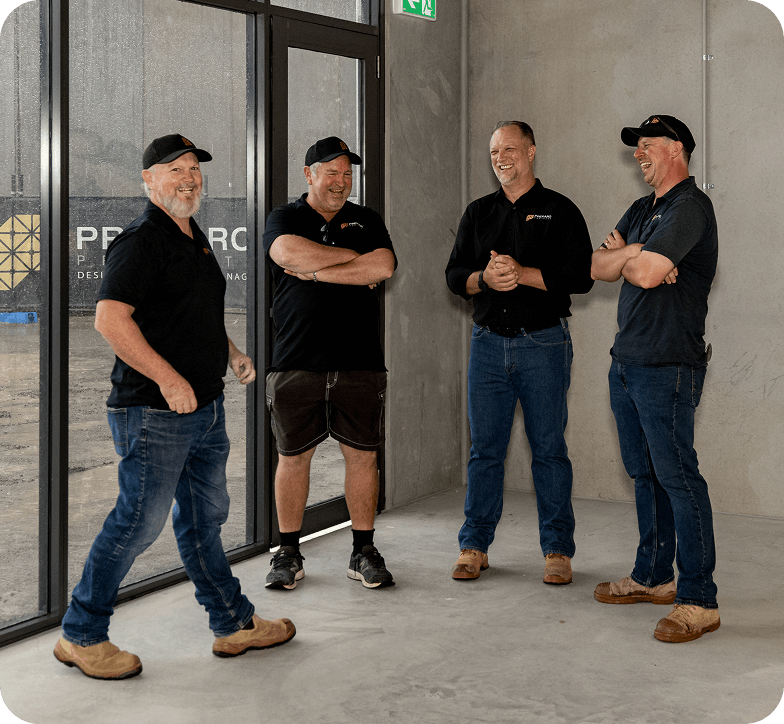

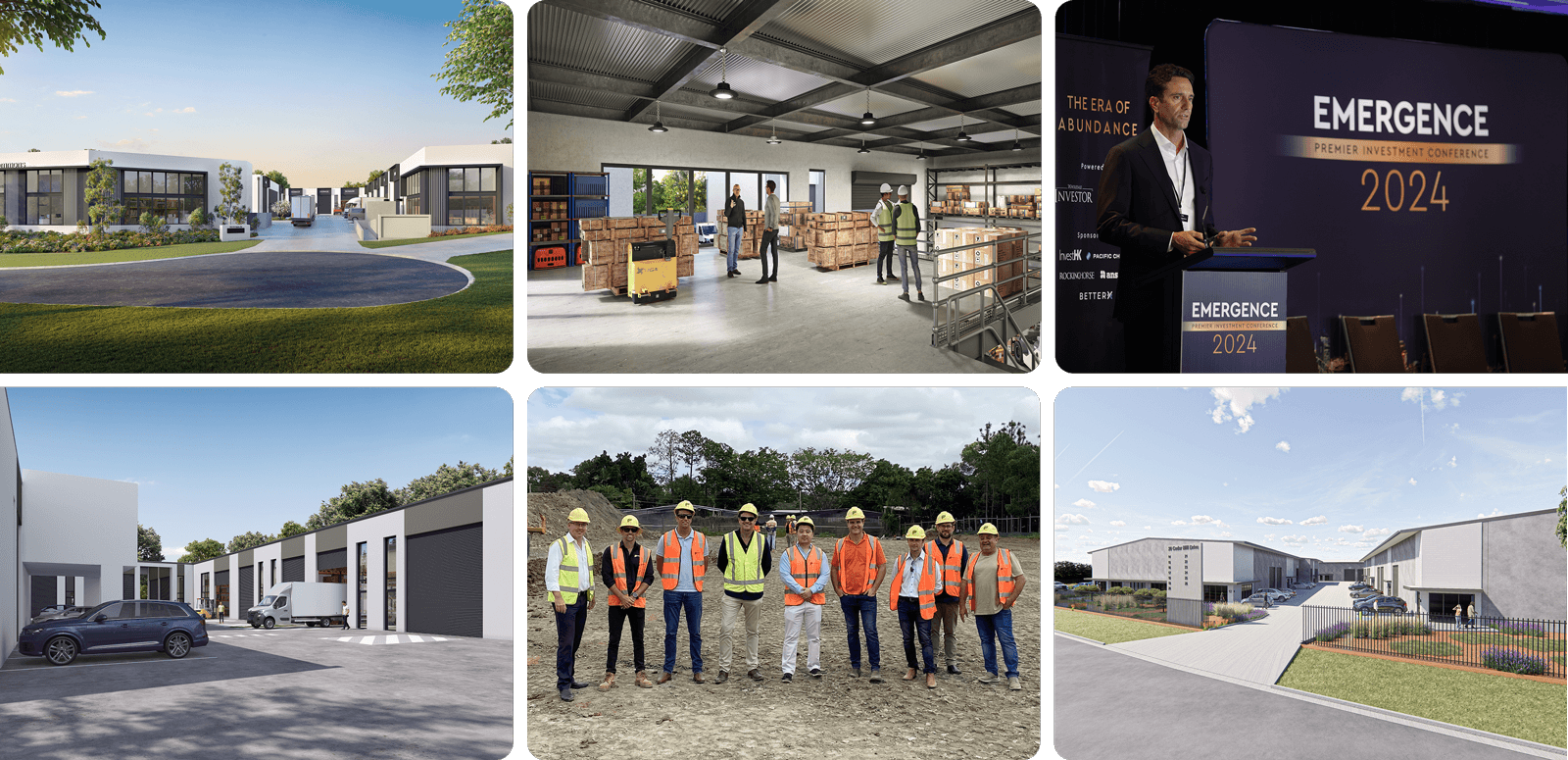

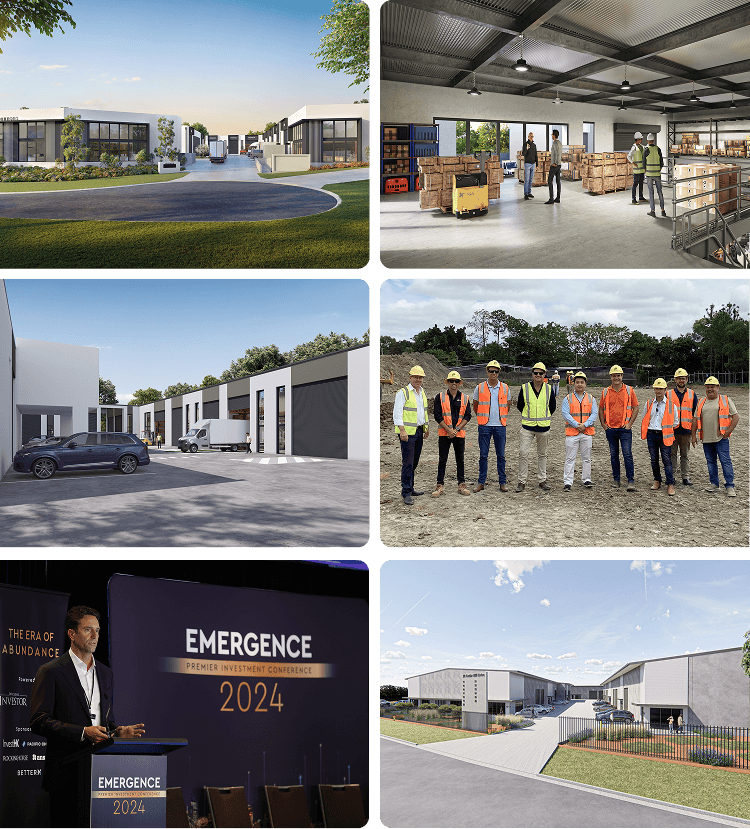

$1 Billion in Oversight. $40 Million Delivered. 100 Years of Experience….

The team behind CCS Development Group has overseen more than $1 billion in construction and major infrastructure projects across Australia and completed $40 million in high-performing industrial projects - with another $60 million in progress. With over 100 years of combined experience in civil engineering, construction, and development, we know how to deliver projects on time, on budget, and with far less risk for investors.

We specialise in tenant-ready Micro Warehouses that generate strong rental income and equity growth. Every site is selected using our proprietary precinct-tagging system, backed by detailed feasibility and real demand. This means you get access to high-yield properties in high-demand locations with long-term upside—without the stress or guesswork of going it alone.

$1 Billion in Oversight. $40 Million Delivered. 100 Years of Experience….

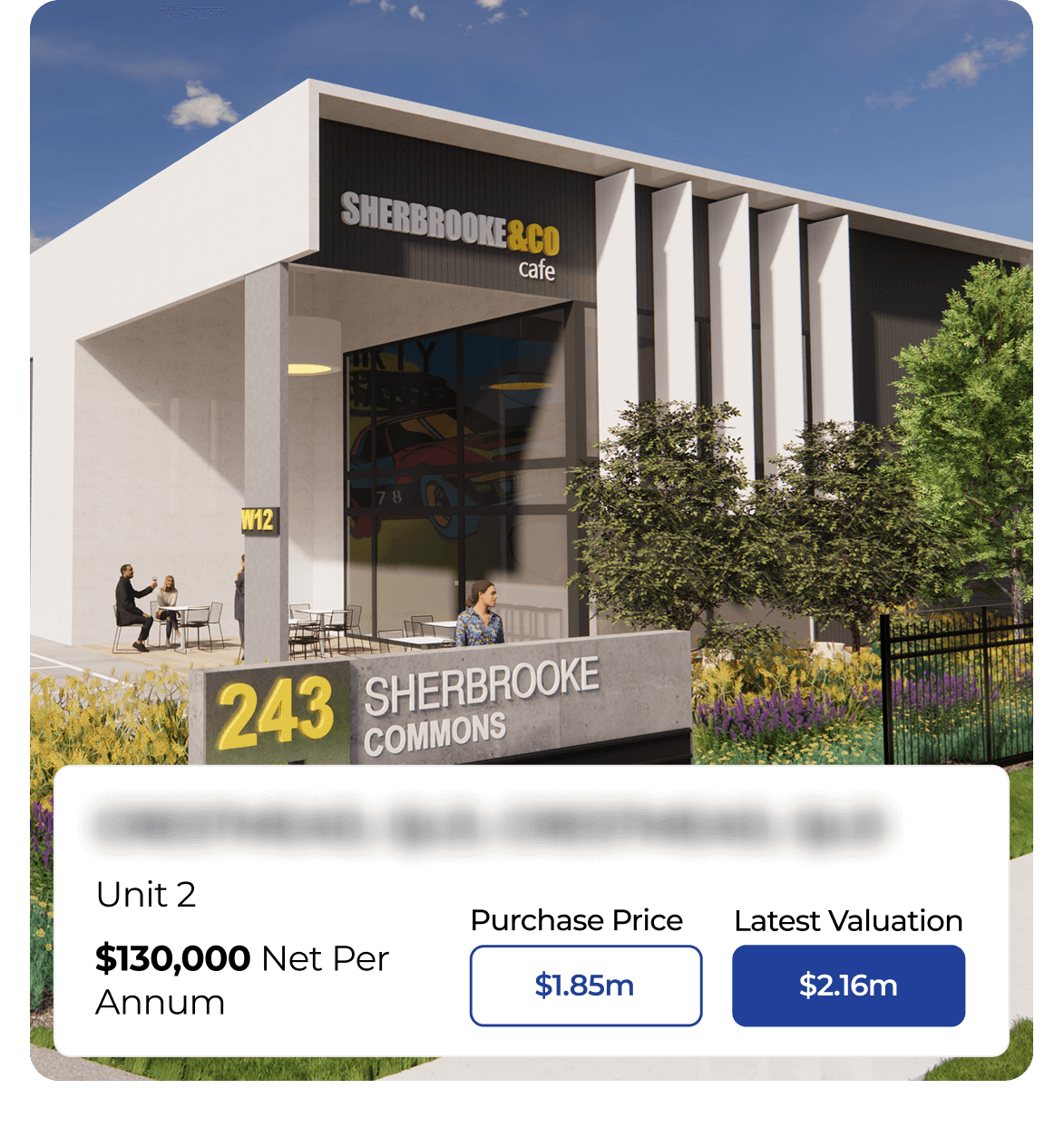

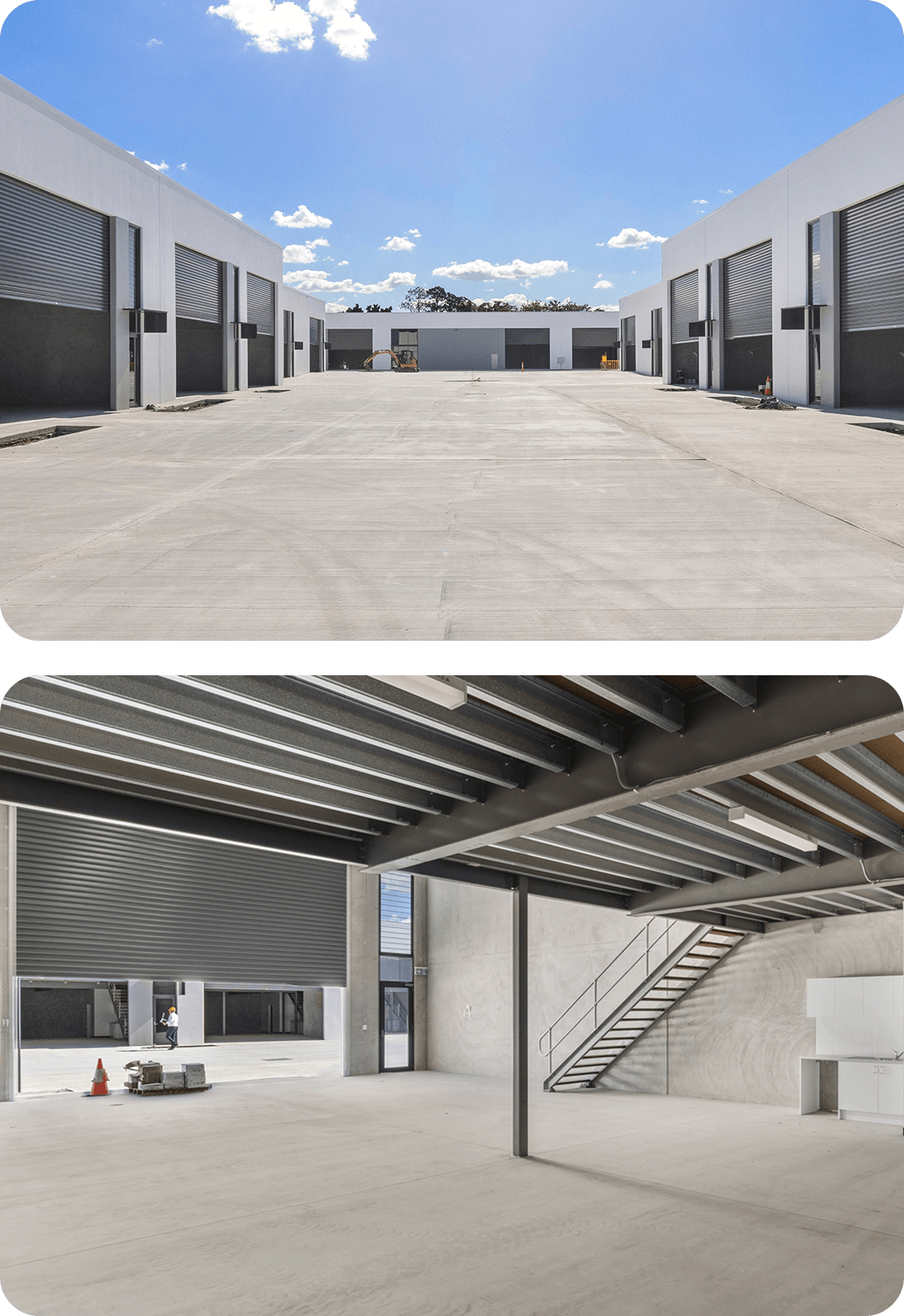

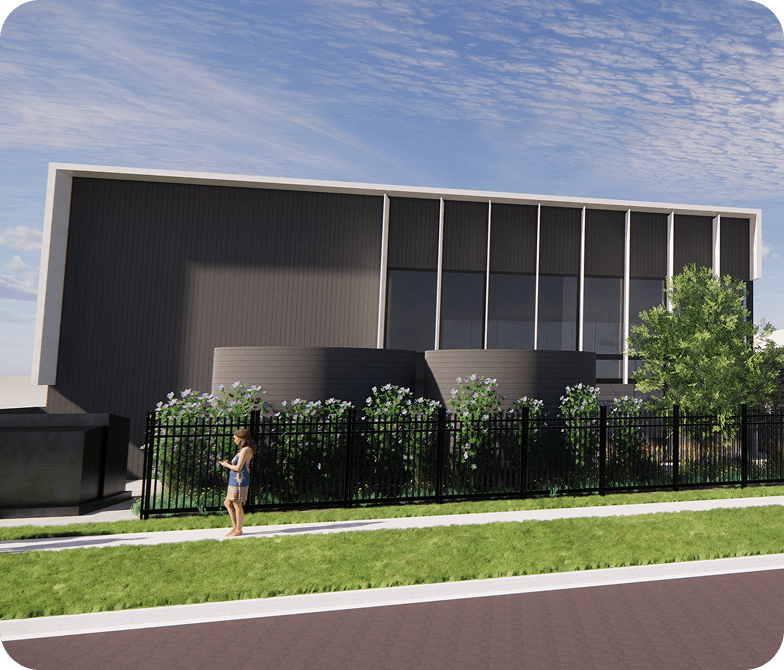

Previous Projects & Upcoming Opportunities

The Smartest Way We’ve Found to Capitalise on This Trend? Micro Warehouses That Can Potentially Make $30k-$70k During Construction…

At CCS Development Group, we build Micro Warehouses. These are small, high-demand industrial spaces placed in council-approved suburbs where population and infrastructure are expanding fast. These projects are usually too small for big institutions to bother with, but they’re perfect for private investors looking for serious upside.

When done right, Micro Warehouses can deliver up to 3.1 times the net cash flow of residential property. We're seeing 6 per cent net yields, long-term commercial tenants, and potential equity gains of $30,000 to $70,000 before the build is even finished. It’s a rare sweet spot combining high demand, low competition, and strong returns. And a chance to grow real wealth without waiting decades.

6% Net Yield On Settlement, $168k P/A Passive Income Potential: Here’s How Micro Warehouses Are Outperforming Residential Property 3 to 1…

Earn 3.1X the Cashflow of Residential With 6%+ Net Yields On Settlement…

Potentially Generate $30,000 to $70,000 in Equity in First 12-18 Months During Construction Phase…

Build Toward $168,000 Per Year in Long-Term Passive Income…

The Confidence Of 3 to 5 Year Tenants…

0.5% Approximate Annual Return From Claiming Depreciation…

Discover the 2 Overlooked Equity Markets Where Smart Investors Are Quietly Earning Six Figures

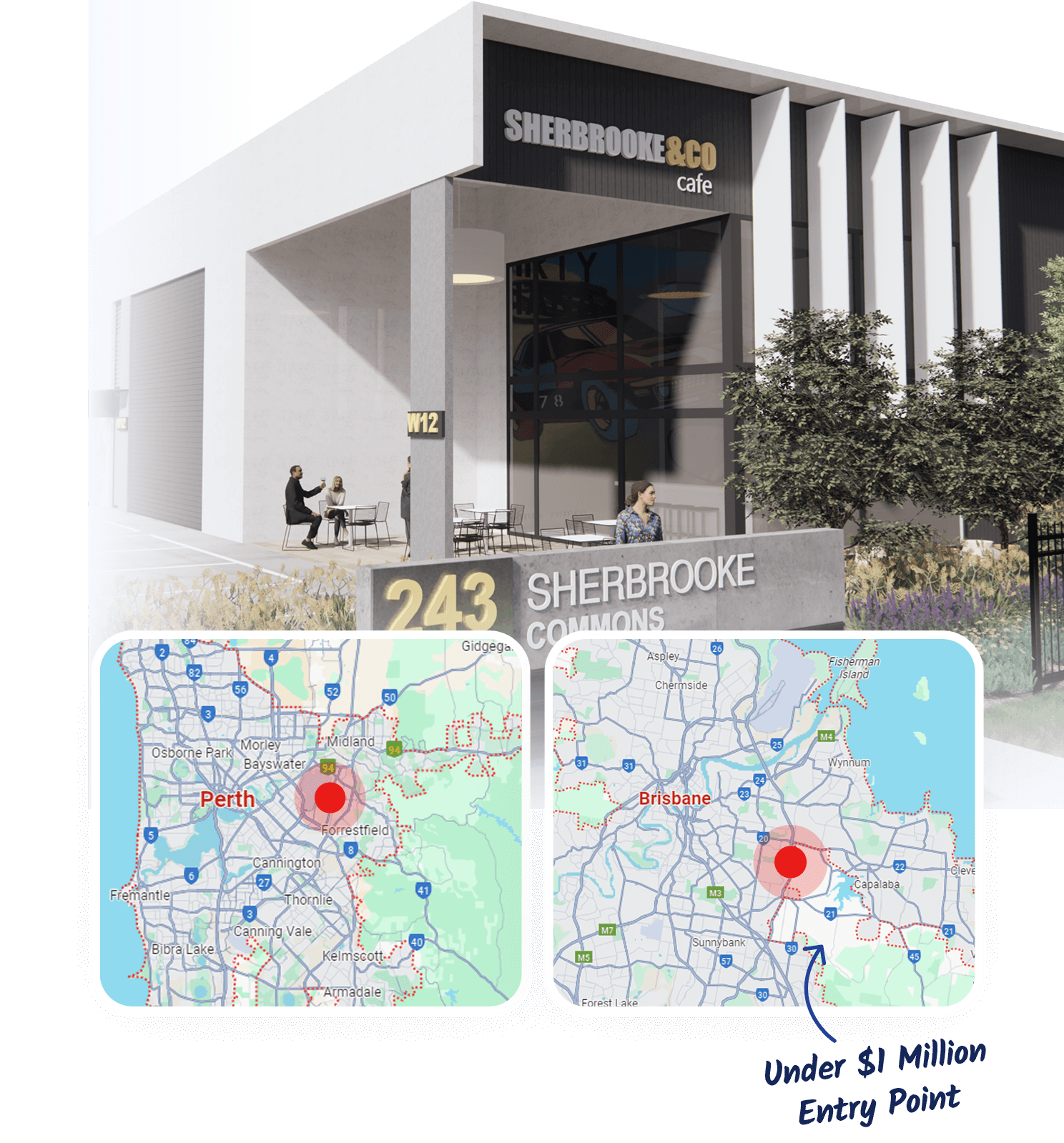

We’ve quietly developed two of the most strategically positioned industrial developments in the country. These are not fringe locations or speculative plays. They sit inside tightly held, council-endorsed growth corridors where infrastructure is expanding, land is running out, and tenant demand is outpacing supply. The exact suburbs? We reveal those inside your Portfolio Shortcut Session. But here’s what we can say: both locations are already positioned to attract high-demand tenants before construction is even complete.

Each opportunity is priced under $1 million and comes pre-leased with a guaranteed 6 percent net yield for 12 months. That means immediate income and the potential for substantial equity uplift during the build. These are limited-release allocations, and once they’re filled, they’re gone. If you want a serious shot at early gains and long-term cash flow, this is your window.

These 2 Hidden Equity Goldmines Are Creating Six-Figure Gains - But Not for Long

A Case Study of $125,000 in Equity Uplift Before a Single Rent Payment Was Collected…

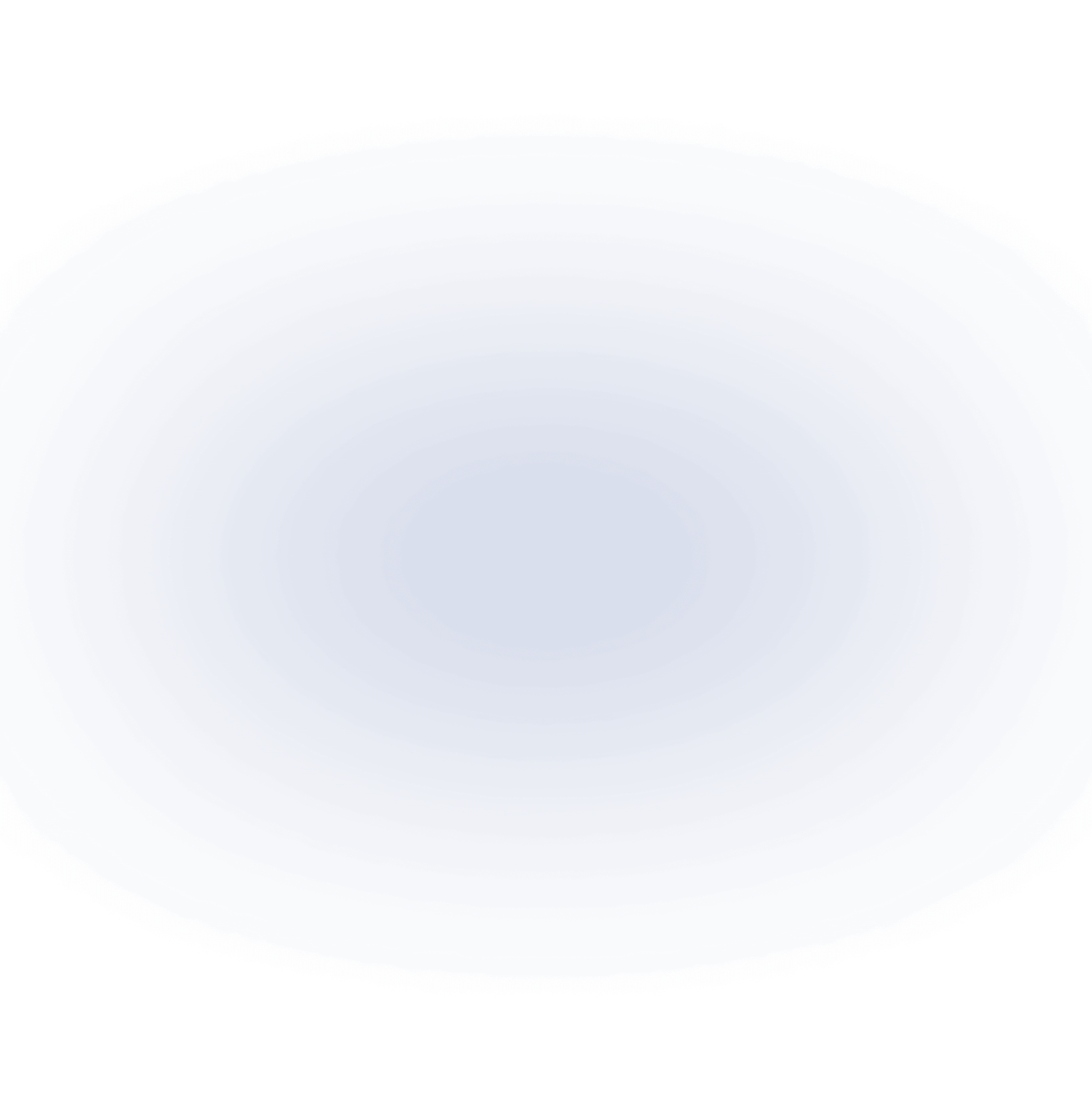

In late 2023, one of our investors secured a Micro Warehouse at Sherbrooke Road in Willawong, a booming industrial hub just 19 kilometres from Brisbane CBD. The purchase price was $575,000, requiring a 10 percent deposit of just $57,500. By the time construction finished in mid-2025, the property was market appraised at $700,000, delivering an equity uplift of $125,000.

That same warehouse was leased at $42,000 per year plus outgoings, delivering immediate rental income from a high-performing, fully occupied asset. Based on the actual purchase and cash-in, that’s around a 60% return on equity, not including ongoing 6% net yields. No holding costs. No vacancies. Just capital growth and income certainty from day one.

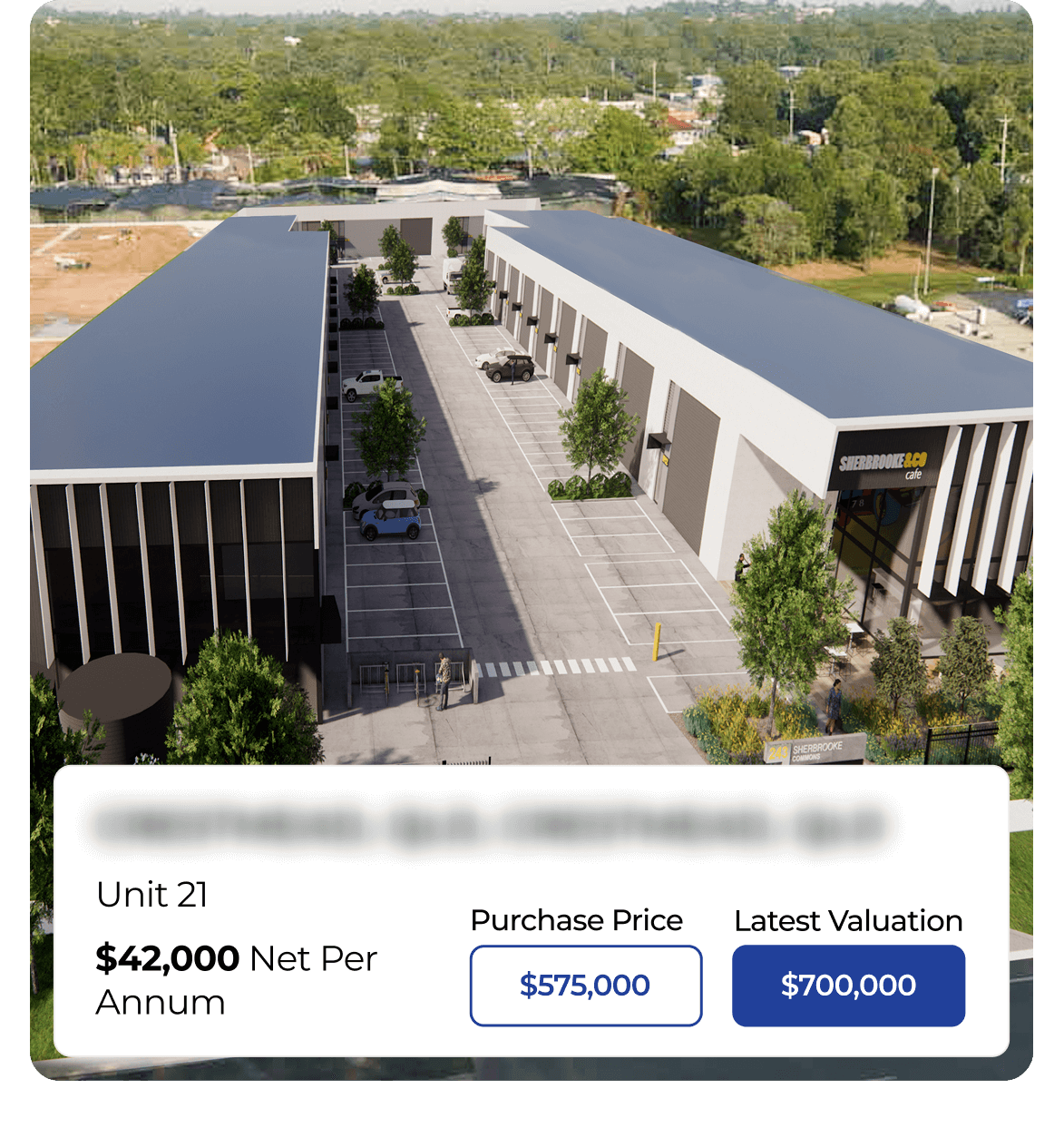

“I purchased a property delivered by CCS Developments with RWC Collective at 243 Sherbrooke Road. The whole process was seamless from contract to settlement. I realised 22% uplift on value based on my new tenant secured prior to settlement and have achieved a 7.3% net yield on my investment! Thanks team!" ~ JAMIE

A Case Study of $300K Equity Uplift in Just 3 Months - During the Rental Guarantee Period…

On the higher end of the scale - massive gains can be had.

In mid-2024, an investor secured a Micro Warehouse on Sherbrooke Road for $1.86M, with just a 10% deposit ($186K).

Settlement was completed in July 2025, with a 12-month rental guarantee locked in at $111,500 per annum (6% net yield).

October 2025 - During the guarantee period, CCS Developments worked alongside RWC Collective and the investor to add a custom office fitout. Within months, this secured a new 3+2 year lease with a tenant paying $130,000 annually.

New valuation: $2.17M. That’s a $300K equity uplift - a 17% jump in capital value - in just 3 months.

The investor’s income increased, the asset’s value surged, and the uplifted equity could now be leveraged or unlocked for future deals.

“Having recently purchased for myself and other investors into Sherbrooke Commons, I can confidently say we are collectively pleased with the entire experience. Personally working in commercial property and developments gives me an appreciation of how well this project was managed. From concept to completion, purchasers were well informed, progress photos and videos were regularly shared, a reputable builder was engaged and the final product is a testament to the quality of outcome. I will be closely following this developer in to the future. Thank you for a job well done from all of us!" ~ H. Collins

How Micro Warehouse Investing With CCS Gives Investors Absolute Confidence…

We’re Not Marketers, We’re Civil Engineers With $1 Billion And 100 Years Of Combined Construction And Major Infrastructure Project Experience

In-House Feasibility, Risk Modelling, and Site Selection For Rental Demand, Growth Pressure, and Long-Term Security

Full End-to-End Development Oversight From Day One

12-Month Rental Guarantee With Tenant Matching Support Included

Projects Delivered On Time, On Budget, and Fully Compliant

Why Tripling Your Yield Doesn’t Just Pay More… It Shortcuts Your Retirement Timeline

Most investors start with $100,000 to $200,000 to invest. Whether you’re buying residential or commercial, you’re likely using a loan to secure the property. That means the real question is this: how much income is your deposit actually producing?

With residential property, your deposit might help you buy a $1,000,000 home. But with net yields around 2 percent, most of that income is wiped out by loan repayments, insurance, and maintenance. In many cases, investors walk away with little or a negative cash flow.

With a Micro Warehouse generating a 6% net yield, a $200,000 deposit could secure a $575,000 asset (based on a 65% commercial LVR). One of our clients purchased a warehouse at this price point and achieved a net income of $42,000. After covering $28,500 in annual interest payments, they still had $13,500 in positive cash flow from day one, excluding any equity gains. This is just one example of how Micro Warehouses can generate real, reinvestable income.

Over time, that extra cash flow compounds. You reach your passive income goals faster. You need fewer properties to hit your target. And for many investors, this is what makes the difference between retiring at 65 or 55.

Getting Started Is Simple and Could Shift The Trajectory Of Your Retirement Timeline…

Book Your Free 30-Minute Portfolio Shortcut Session

Spots are limited and available by application only. In this free session, we’ll assess your goals and walk you through live opportunities. You’ll see how Micro Warehouses can deliver up to 3.1 times the cash flow of residential, while building a portfolio designed for long-term income and growth.

Let Our Expert Team Handle the Heavy Lifting With Rigorous Due Diligence

Behind the scenes, our team of engineers and property professionals handle every stage of development and handover with precision. From site analysis and feasibility modelling to council approvals and build quality, your investment is backed by expert oversight and real-world data. This is how we ensure every asset we deliver is first grade.

Secure a Cashflow-Ready Property With Built-In Demand

You’ll get access to Micro Warehouses in tightly held industrial corridors, fully tenanted and ready to perform. Each property comes pre-leased with a guaranteed 6 percent net yield for the first 12 months, giving you immediate income and complete peace of mind from settlement.

Watch Your Equity Grow and Rental Income Roll In

With long-term tenants in place and the potential to unlock $30,000 to $70,000 in equity uplift during construction, you can start building momentum right away. This is how smart investors are moving toward $168,000 per year in passive income without relying on speculative residential growth.

After Millions Worth Of Successful Industrial Property Developments, Here’s What Our Clients Say…

-

![]()

I purchased a property delivered by CCS Developments with RWC Collective at 243 Sherbrooke Road. The whole process was seamless from contract to settlement. I realised 18% uplift on value based on my new tenant secured prior to settlement and have achieved a 7.3% net yield on my investment! Thanks team

Jamie

Verified Review

-

![]()

I have worked with the CCS team for over 3 years. During that time, I have always found them to be professional and diligent in their dealings. I look forward to working with them on future projects.

Sarah B.

Verified Review

-

![]()

I can confidently say we are collectively pleased with the entire experience. Personally working in commercial property and developments gives me an appreciation of how well this project was managed. From concept to completion, purchasers were well informed. I will be closely following this developer in to the future. Thank you for a job well done from all of us!

Hoss

Verified Review

-

![]()

CCS Developments are always a pleasure to partner with. Their projects are thoughtfully structured and well-managed, which sets the stage for success. We’ve consistently achieved high-quality outcomes that both teams can be proud of. It’s a true partnership built on mutual trust, accountability, and a shared focus on delivering excellence.

Prekaro Projects

Verified Review

-

![]()

I purchased a property delivered by CCS Developments with RWC Collective at 243 Sherbrooke Road. The whole process was seamless from contract to settlement. I realised 18% uplift on value based on my new tenant secured prior to settlement and have achieved a 7.3% net yield on my investment! Thanks team

Jamie

Verified Review

-

![]()

I have worked with the CCS team for over 3 years. During that time, I have always found them to be professional and diligent in their dealings. I look forward to working with them on future projects.

Sarah B.

Verified Review

-

![]()

I can confidently say we are collectively pleased with the entire experience. Personally working in commercial property and developments gives me an appreciation of how well this project was managed. From concept to completion, purchasers were well informed. I will be closely following this developer in to the future. Thank you for a job well done from all of us!

Hoss

Verified Review

-

![]()

CCS Developments are always a pleasure to partner with. Their projects are thoughtfully structured and well-managed, which sets the stage for success. We’ve consistently achieved high-quality outcomes that both teams can be proud of. It’s a true partnership built on mutual trust, accountability, and a shared focus on delivering excellence.

Prekaro Projects

Verified Review

-

![]()

I purchased a property delivered by CCS Developments with RWC Collective at 243 Sherbrooke Road. The whole process was seamless from contract to settlement. I realised 18% uplift on value based on my new tenant secured prior to settlement and have achieved a 7.3% net yield on my investment! Thanks team

Jamie

Verified Review

-

![]()

I have worked with the CCS team for over 3 years. During that time, I have always found them to be professional and diligent in their dealings. I look forward to working with them on future projects.

Sarah B.

Verified Review

-

![]()

I can confidently say we are collectively pleased with the entire experience. Personally working in commercial property and developments gives me an appreciation of how well this project was managed. From concept to completion, purchasers were well informed. I will be closely following this developer in to the future. Thank you for a job well done from all of us!

Hoss

Verified Review

-

![]()

CCS Developments are always a pleasure to partner with. Their projects are thoughtfully structured and well-managed, which sets the stage for success. We’ve consistently achieved high-quality outcomes that both teams can be proud of. It’s a true partnership built on mutual trust, accountability, and a shared focus on delivering excellence.

Prekaro Projects

Verified Review

-

![]()

I purchased a property delivered by CCS Developments with RWC Collective at 243 Sherbrooke Road. The whole process was seamless from contract to settlement. I realised 18% uplift on value based on my new tenant secured prior to settlement and have achieved a 7.3% net yield on my investment! Thanks team

Jamie

Verified Review

-

![]()

I have worked with the CCS team for over 3 years. During that time, I have always found them to be professional and diligent in their dealings. I look forward to working with them on future projects.

Sarah B.

Verified Review

-

![]()

I can confidently say we are collectively pleased with the entire experience. Personally working in commercial property and developments gives me an appreciation of how well this project was managed. From concept to completion, purchasers were well informed. I will be closely following this developer in to the future. Thank you for a job well done from all of us!

Hoss

Verified Review

-

![]()

CCS Developments are always a pleasure to partner with. Their projects are thoughtfully structured and well-managed, which sets the stage for success. We’ve consistently achieved high-quality outcomes that both teams can be proud of. It’s a true partnership built on mutual trust, accountability, and a shared focus on delivering excellence.

Prekaro Projects

Verified Review

-

![]()

After years of feeling stuck with our residential investment property. CCS introduced us to their micro-warehouse strategy, and the difference has been incredible. We’ve had guaranteed rental income and far better returns than we ever saw in residential real estate. The yields are real, the process was straightforward, we feel like early retirement is within reach.

Mark J.

Verified Review

-

![]()

The outcome has been excellent- clear communication outlining both the successes and the challenges; a shorter time frame for a commercial build compared to a residential one; an excellent return on our investment; and the opportunity to invest in another deal. We will definitely continue to invest with Ben and Asher and would recommend investing with them to others

L. Cheehy

Verified Review

-

![]()

This integrated approach ensured seamless coordination with Prekaro Projects during construction and enabled prompt resolution of any onsite complexities.We confidently recommend CCS as a capable and reliable delivery partner for industrial projects as evidence by 6 past projects across SE QLD and NSW.

Tim A.

Verified Review

-

![]()

Investing with CCS Development Group has allowed us to diversify our property investments both geographically and across different sectors. CCS Development Group have been transparent in their dealings and their communication with us as investors has been excellent providing regular updates on the status of the various projects.

Joshua M.

Verified Review

-

![]()

After years of feeling stuck with our residential investment property. CCS introduced us to their micro-warehouse strategy, and the difference has been incredible. We’ve had guaranteed rental income and far better returns than we ever saw in residential real estate. The yields are real, the process was straightforward, we feel like early retirement is within reach.

Mark J.

Verified Review

-

![]()

The outcome has been excellent- clear communication outlining both the successes and the challenges; a shorter time frame for a commercial build compared to a residential one; an excellent return on our investment; and the opportunity to invest in another deal. We will definitely continue to invest with Ben and Asher and would recommend investing with them to others

L. Cheehy

Verified Review

-

![]()

This integrated approach ensured seamless coordination with Prekaro Projects during construction and enabled prompt resolution of any onsite complexities.We confidently recommend CCS as a capable and reliable delivery partner for industrial projects as evidence by 6 past projects across SE QLD and NSW.

Tim A.

Verified Review

-

![]()

Investing with CCS Development Group has allowed us to diversify our property investments both geographically and across different sectors. CCS Development Group have been transparent in their dealings and their communication with us as investors has been excellent providing regular updates on the status of the various projects.

Joshua M.

Verified Review

-

![]()

After years of feeling stuck with our residential investment property. CCS introduced us to their micro-warehouse strategy, and the difference has been incredible. We’ve had guaranteed rental income and far better returns than we ever saw in residential real estate. The yields are real, the process was straightforward, we feel like early retirement is within reach.

Mark J.

Verified Review

-

![]()

The outcome has been excellent- clear communication outlining both the successes and the challenges; a shorter time frame for a commercial build compared to a residential one; an excellent return on our investment; and the opportunity to invest in another deal. We will definitely continue to invest with Ben and Asher and would recommend investing with them to others

L. Cheehy

Verified Review

-

![]()

This integrated approach ensured seamless coordination with Prekaro Projects during construction and enabled prompt resolution of any onsite complexities.We confidently recommend CCS as a capable and reliable delivery partner for industrial projects as evidence by 6 past projects across SE QLD and NSW.

Tim A.

Verified Review

-

![]()

Investing with CCS Development Group has allowed us to diversify our property investments both geographically and across different sectors. CCS Development Group have been transparent in their dealings and their communication with us as investors has been excellent providing regular updates on the status of the various projects.

Joshua M.

Verified Review

-

![]()

After years of feeling stuck with our residential investment property. CCS introduced us to their micro-warehouse strategy, and the difference has been incredible. We’ve had guaranteed rental income and far better returns than we ever saw in residential real estate. The yields are real, the process was straightforward, we feel like early retirement is within reach.

Mark J.

Verified Review

-

![]()

The outcome has been excellent- clear communication outlining both the successes and the challenges; a shorter time frame for a commercial build compared to a residential one; an excellent return on our investment; and the opportunity to invest in another deal. We will definitely continue to invest with Ben and Asher and would recommend investing with them to others

L. Cheehy

Verified Review

-

![]()

This integrated approach ensured seamless coordination with Prekaro Projects during construction and enabled prompt resolution of any onsite complexities.We confidently recommend CCS as a capable and reliable delivery partner for industrial projects as evidence by 6 past projects across SE QLD and NSW.

Tim A.

Verified Review

-

![]()

Investing with CCS Development Group has allowed us to diversify our property investments both geographically and across different sectors. CCS Development Group have been transparent in their dealings and their communication with us as investors has been excellent providing regular updates on the status of the various projects.

Joshua M.

Verified Review

Our “6% Rental Yield” Guarantee

Most residential properties barely return a 2% net rental yield… and that’s before you factor in vacancy, interest payments, and management headaches.

At CCS, we’re so confident in the strength of our industrial locations and the quality of our developments that we guarantee a 6% net rental yield for the first 12 months.

No vacancy risk on settlement. No surprises. Just immediate, predictable income from day one. This isn’t wishful thinking… it’s engineered certainty

OFFER FOR THE FIRST 10 AUSSIES LOOKING TO RETIRE EARLY:

Give Us 30 Minutes And We’ll Give You Access To The Exact High-Yield Industrial Investment Opportunities That Can Shortcut Your Retirement 10 Years!

Here’s just a fraction of what you’ll discover in your FREE ‘Portfolio Shortcut’ Session:

-

The 2 most lucrative industrial developments in Australia right now and how to claim your stake before they’re fully allocated

-

Our exact strategy to achieve 6% guaranteed rental yields on settlement and how it outperforms residential by up to 3X

-

Where the smart money is going… including how to invest using your SMSF or lease doc loan

-

Why sub-$1M industrial opportunities are vanishing and how to secure one before minimum prices exceed $1.5M